But in a world of shifting trade dynamics, tariffs are quietly reshaping the way these products are made—and more importantly, what they can become. The conversation about tariffs often centers on price, inflation, and macroeconomics. But for global CPG companies, the more dangerous impact is on innovation—especially the kind consumers never see.

Let’s take a 360-degree look at what tariffs really do to an everyday product like body wash—from the consumer shelf to the heart of R&D labs and brand teams—and how companies can respond before the creative engine behind these brands begins to stall.

What the Consumer Feels: Price, Packaging, and Performance

The first layer of tariff impact is obvious. When raw materials, fragrance compounds, or packaging components are hit with tariffs, costs rise. Body washes are particularly sensitive—they rely on surfactants, essential oils, plastic components, and even imported pumps or labels. Each piece may come from a different country, and each is now a potential liability.

Brands may respond with price increases, but often they turn to subtler tactics: shrinking the bottle size (shrinkflation), diluting the formula, swapping out expensive ingredients for cheaper ones, or changing packaging materials. The product may still look familiar, but the feel, lather, or scent experience might not be quite the same.

These are the kinds of changes consumers notice—not in headlines, but in hesitation. A slightly less luxurious lather. A pump that sticks. A favorite scent that quietly disappears.

What the Company Feels: Complexity, Compliance, and Caution

Behind the scenes, tariffs introduce friction at every stage of production and launch. Global brands rely on intricate sourcing networks—palm oil derivatives from Southeast Asia, preservatives from Europe, sustainable plastics from North America. A single tariff along that chain can force product teams into costly reformulations or supply chain reroutes.

Even localization—often presented as a solution—isn’t a silver bullet. Manufacturing closer to the consumer doesn’t eliminate global exposure. Equipment for manufacturing or logistics might still be imported. Spare parts might be sourced from Europe. And the skilled labor to run specialized lines might be difficult to hire or retain. Local doesn’t always mean resilient—just differently vulnerable.

Meanwhile, the operational overhead increases. Reformulations require new stability tests, regulatory filings, labeling updates, and quality audits—all of which slow down time-to-market and quietly siphon resources away from innovation.

What Innovation Loses: The Pipeline Effect

Perhaps the most overlooked consequence is what never reaches the shelf.

Body wash brands are constantly experimenting: cleaner ingredient decks, microbiome-friendly formulations, waterless formats, compostable bottles. These aren’t marketing gimmicks—they’re the next wave of differentiation and sustainability.

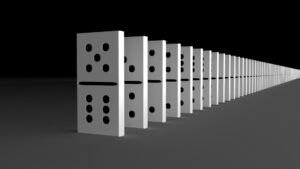

But tariffs complicate scale. That compostable bottle material being piloted in one market? If it’s tariffed in another, the rollout stalls. The ingredient supplier co-developing a biotech surfactant? If they’re overseas and face trade restrictions, the partnership may fall apart.

Worse, innovation teams may start self-censoring—skipping bolder ideas because the operational hurdles feel too high. Launch calendars shift toward what’s safe, repeatable, and tariff-proof. Risk tolerance drops. Product pipelines narrow. Creativity quietly contracts.

The Human Impact: Talent Fatigue and Strategic Drift

And here’s the part that rarely gets discussed: the people behind the products.

R&D chemists, packaging engineers, brand managers, procurement leads—these are the minds driving innovation forward. But in a tariff-heavy world, their work becomes less about envisioning the future and more about solving yesterday’s emergencies.

Formulators spend more time finding replacements for now-tariffed ingredients than working on novel textures. Marketers wrestle with how to tell authentic stories when products are being reformulated behind the scenes. Procurement teams are locked in a perpetual cycle of renegotiation and rerouting. Supply chain leads are firefighting around parts shortages and shipping delays.

The result? Burnout. Frustration. Attrition. And a creeping shift in company culture—from ambitious to defensive, from consumer-led to compliance-led.

What Companies Can Do: Building a Resilient Innovation System

To maintain momentum in a world shaped by tariffs and uncertainty, CPG companies need to stop treating innovation as a luxury and start treating it as a core asset worth protecting.

- Build modularity into formulations and packaging so that ingredient swaps or format changes don’t derail product integrity.

- Rethink localization with clear-eyed realism. Map every dependency, not just geography—including machinery, IP, and talent pools.

- Create protected innovation budgets and teams that can work independently from the daily churn of operational fire drills.

- Double down on cross-functional collaboration—when marketers, scientists, and supply chain leaders build together, the ideas are more resilient and more realistic.

- Anchor teams in long-term purpose, not just quarterly wins. People stay invested when their work still feels like it’s building toward something meaningful—even in a volatile world.

Tariffs don’t just change what a body wash costs. They change what it is. And more dangerously, they shape what it may never become.

In a world of trade wars and fractured globalization, the real risk for CPG brands isn’t that they fall behind on price. It’s that they fall behind on possibility.

Click here for more columns by Gail Martino; if you enjoy this content, please consider connecting with Gail Martino on LinkedIn.

Contributor

-

Gail Martino, Ph.D is a thought leader and global innovation leader in the fast-moving consumer goods industry, having worked with billion-dollar brands at Unilever and previously at Gillette. With a background spanning both corporate and academic roles, Gail has a proven track record in developing and executing highly effective innovation ecosystems, driving value through strategic partnerships and internal product development. Notably, she has been a valued member of the advisory board for the Front End of Innovation conference since 2015.

View all posts