Taking a Store Tour Through Dollar Tree

Last week, I walked into my local Dollar Tree and stopped in my tracks.

On the shelf sat full skincare systems—collagen cleansers, retinol serums, vitamin C creams—each priced at $1.25. Not sample sizes, not clearance leftovers, but complete routines that once belonged squarely in the “masstige” aisle of drugstores or department counters.

A decade ago, ingredients like retinol, collagen, peptides, and vitamin C were locked inside $30 serums or $80 creams. These compounds are hard to stabilize and formulate for efficacy so only companies with labs, R&D teams, and clinical budgets could deliver them. As a result, the products carried prestige positioning and aspirational price tags.

Today, you can buy a cleanser, serum, and cream with those very same ingredients for under $4 total, stocked next to paper towels and dish soap.

And it isn’t just skincare. That same store carried a 3-pack of disposable 5-blade Assure razors (a direct Gillette dupe) for $1.25, about 42 cents each. By comparison, Walmart sells Gillette’s 2-pack of 5-blade disposables for $9.97, or $4.98 each. That’s 12 times more expensive.

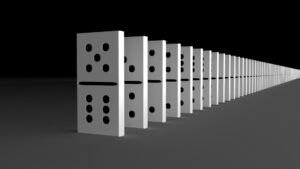

When I worked in Gillette’s Blades and Razors group, the brand commanded 70% market share. Over time, that dominance eroded as Schick, Harry’s, Dollar Shave Club, and countless private labels chipped away. The core dynamic is the same: technology that once justified “premium” price points eventually diffuses down to the lowest tier of retail.

So what does “premium” mean when collagen, retinol, and 5-blade razors all sell for $1.25?

Identifying The Innovation Squeeze

Innovation costs money. Formulation science, clinical validation, patents, packaging design, and brand campaigns all require investment. But when Dollar Tree sets the consumer’s reference price at $1.25, the pressure on mid-tier and prestige brands intensifies.

Shoppers today are also more ingredient-literate. Social media has trained them to recognize “retinol” as anti-aging, “collagen” as skin-supporting, “five blades” as superior. When they see those same cues at mass retail, they don’t forget the association, or the price.

Recommendations for Product Developers

Compete where Dollar Tree and many mass retailers cannot go—shifting beyond the product features itself and moving towards a branding and marketing position that highlights the special experiences of your product.

- Beyond ingredients: Assume commoditization is inevitable. Differentiate on delivery systems, clinically proven efficacy, and long-term results that cheap dupes can’t replicate.

- Experience as value: Use packaging, sensorial textures, fragrance sophistication, and omnichannel services (e.g., personalization, virtual consultations) to create experiences mass retail can’t match.

- Credibility and trust: A $1.25 collagen cream may tempt trial, but consumers still look to trusted brands for safety, testing, and measurable outcomes. Highlight proof, not just ingredients.

- Tell a stronger story: Dollar Tree can sell a retinol serum, but not a 50-year dermatology legacy, a patented delivery system, or a loyal community of advocates.

- Go where cheap can’t follow: Personalization, AI-driven recommendations, and biotech-derived actives create defensible moats beyond “same ingredients, lower price.”

- Stay ahead of commoditization: Cycle faster. Launch next-gen actives, formats, or routines before they trickle down into mass retail.

Evolving a Product’s Premium Message

If every masstige technology eventually becomes mass, the very definition of “premium” must evolve. Ingredients and features are no longer moats. The future of innovation will be measured in outcomes, experiences, and trust.

Collagen sets and 5-blade razors may both sell for $1.25, but consumers will still pay more when a product makes them feel confident, cared for, and certain it works. Premium won’t mean “more blades” or “stronger actives.” Premium will mean proof, personalization, and emotional resonance.

The challenge for innovators is clear: Stop chasing features that will soon be commoditized and start building value that can’t be.

Click here for more columns by Gail Martino; if you enjoy this content, please consider connecting with Gail Martino on LinkedIn.

Contributor

-

Gail Martino, Ph.D is a thought leader and global innovation leader in the fast-moving consumer goods industry, having worked with billion-dollar brands at Unilever and previously at Gillette. With a background spanning both corporate and academic roles, Gail has a proven track record in developing and executing highly effective innovation ecosystems, driving value through strategic partnerships and internal product development. Notably, she has been a valued member of the advisory board for the Front End of Innovation conference since 2015.

View all posts